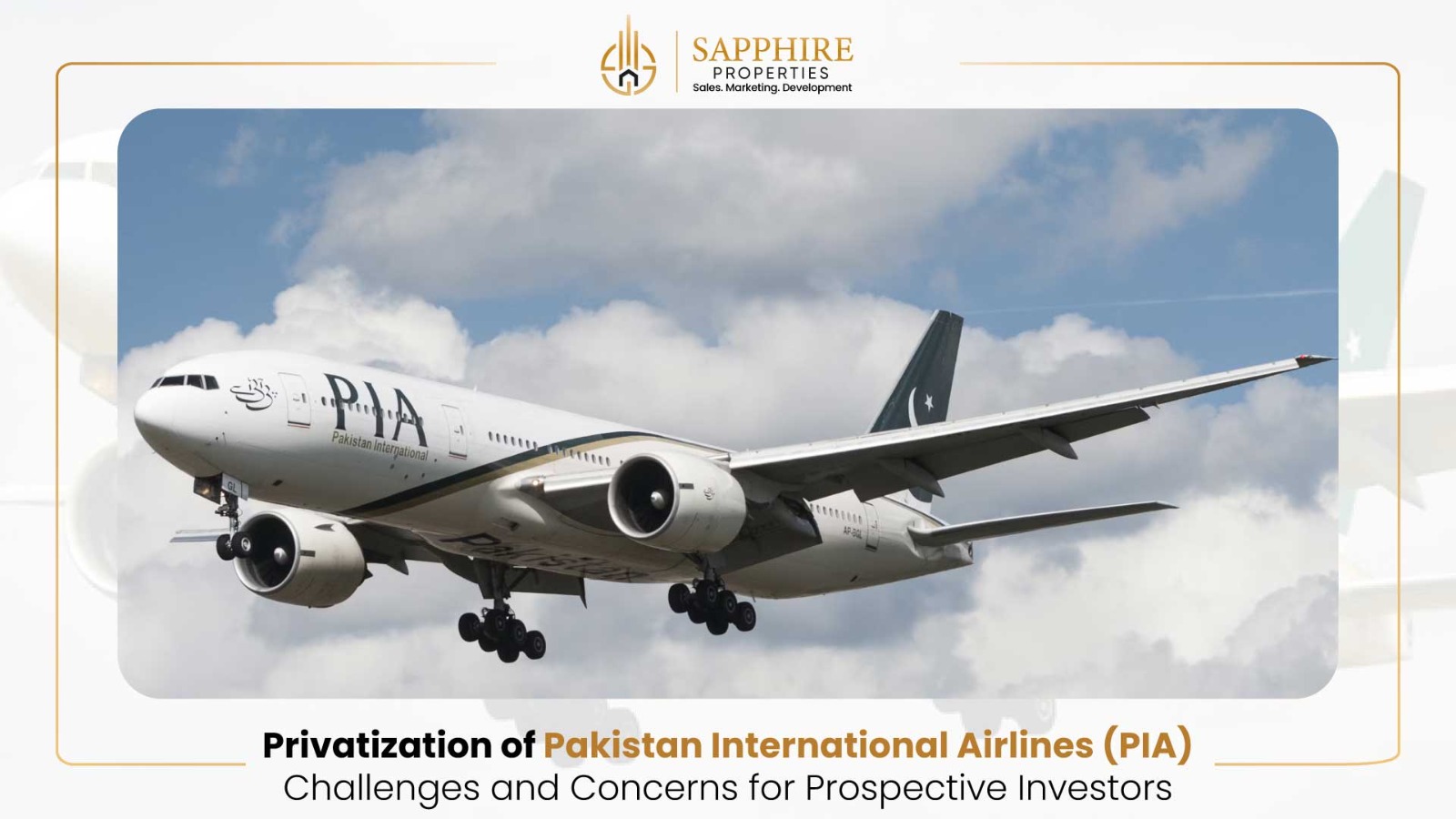

The recent privatization efforts surrounding Pakistan International Airlines (PIA) have spotlighted the complex landscape that surrounds state-owned enterprises in Pakistan. The government aimed to divest a majority stake in PIA to alleviate financial strain and drive reform as part of its commitment under a $7 billion International Monetary Fund (IMF) agreement. Despite six pre-qualified groups, only Blue World City, a real-estate development firm, submitted a bid. The bid, however, was significantly lower than the government’s reserve price of Rs85 billion, igniting debates over the airline’s valuation and the feasibility of its privatization.

Blue World City’s Bid and Government Expectations

Blue World City’s offer of Rs10 billion for a 60% stake in PIA fell well below the government’s set minimum price, prompting authorities to request the bidder to revise its offer. Saad Nazir, Chairman of Blue World City, voiced reluctance to increase the bid, citing commercial infeasibility given the airline’s debt and underlying issues. “The minimum price set by the government doesn’t reflect the financial reality of an organization facing severe financial leakages,” Nazir said, indicating his concern over PIA’s financial health.

Nazir further stated that if the government did not accept the bid, Blue World City would consider launching its own airline. The chairman’s remarks underscore the challenges investors face in evaluating state-owned enterprises like PIA, whose legacy issues and substantial debt diminish its appeal despite potential growth in Pakistan’s aviation sector.

Concerns Over Policy Continuity

One of the major deterrents for potential bidders is the uncertain political landscape. Several executives from the pre-qualified groups expressed concern over the government’s ability to honor long-term agreements. With a coalition government under Prime Minister Shehbaz Sharif, there is an inherent risk of policy shifts if a new administration comes to power. This fear has been amplified by recent incidents, including the government’s decision to terminate power purchase agreements with private companies. Such actions have raised doubts about the government’s commitment to safeguarding investor interests, making it harder for new investors to trust in the stability of sovereign contracts.

Sakib Sherani, an economist with Macro Economic Insights, noted that the frequent renegotiations of private power agreements have undermined investor confidence. Although government officials assert that contractual obligations are respected, the precedent of abrupt revisions has introduced an added layer of uncertainty for potential investors considering long-term commitments in Pakistan.

Legacy Issues and Financial Viability

PIA’s financial struggles are a significant factor deterring potential buyers. With mounting debts and a tarnished reputation due to legacy operational issues, the airline faces a challenging path to profitability. The significant restructuring needed to address these issues may involve layoffs, a prospect that previous governments have avoided due to the unpopularity of such measures. As a result, PIA’s workforce remains bloated, contributing to its financial strain. Moreover, the carrier’s reputation has suffered over time due to mismanagement and inefficiencies, posing an added hurdle for any investor looking to turn it around.

Investor Sentiments and Economic Risks

Another pressing concern for prospective investors is Pakistan’s inconsistent tax policies and sector-specific regulations, which have hindered investment in the past. Frequent changes to policies and tax structures on sectors like aviation make it difficult for investors to project long-term returns, especially in a volatile market. This has cast a shadow over PIA’s privatization, as potential investors are wary of unforeseen costs that could erode profitability.

In light of the challenging investment climate, Mohammed Sohail, CEO of Topline Securities, suggested that the government might need to reassess its privatization strategy. The large gap between Blue World City’s offer and the reserve price indicates that the government’s expectations may not align with market reality, necessitating either a revision of the reserve price or a reevaluation of PIA’s financial model to make it more attractive to buyers.

The Path Forward

The privatization of PIA is pivotal to Pakistan’s broader economic reform agenda. However, for this initiative to succeed, the government must address investor concerns, including ensuring policy continuity, reducing operational inefficiencies, and fostering a more transparent and predictable business environment. Only through a balanced approach can the government attract credible investors, fulfill its IMF commitments, and ultimately set PIA on a sustainable course towards recovery.