Real Estate Investment Trusts (REITs) have become increasingly popular among investors. These trusts are popular among those seeking exposure to the real estate market without the hassle of directly owning and managing properties. Two primary categories within the REIT universe are Equity REITs and Mortgage REITs, each offering distinct investment opportunities and risk profiles. The given article will focus on Equity REIT vs Mortgage REIT.

After reading the article, you will get to know all about REITs and their types. We will also compare Equity REITs with Mortgage REITs to help you understand and make informed decisions.

Before comparing both REITS, let’s first get to know what REIT is. Then we will discuss its types, and then we will make you understand the major difference between the two.

REIT is known as Real Estate Investment Trust (REIT). It is a company that keeps, runs, or finances income-generating real estate. These companies or trusts enable investors to increase their money and invest that money in different real estate assets. These companies are mostly in trend, particularly on stock exchanges, and offer accessible and liquid investment options for those wanting to get involved in the real estate market. It is also good for those who want to enter the Pakistan real estate market without having physical properties.

There are several types of REITs, and they are differentiated by the type of real estate investments. The two main classifications are Equity REITs and Mortgage REITs. Each of these REITs assists in distinct roles within the real estate investment setting. Let’s discuss Equity REIT vs Mortgage REIT.

These are the most common types of REITs and focus on obtaining, owning, and handling income-generating real estate properties. Among these possessions, you can count on residential plots, commercial spaces, hotels, malls, shopping centers, and industrial facilities. For the properties, the revenue comes from the rent payments. This is the type of REIT that helps investors get an advantage from both rental income and property appreciation.

One key feature of Equity REITs is their responsibility to allocate at least 90% of their taxable income as shares to shareholders. So, when it comes to Equity REIT vs Mortgage REIT, it is the major difference between the two. These distinctive properties make them a great choice for investors who want to generate income, as the regular dividends provide a steady stream of cash flow.

You may also like:

Now, if we talk about the Mortgage REIT, it operates differently from Equity REITs. In this REIT, there is no need to own a physical property; the mortgage companies invest in loans. Most companies secure these loans by real estate and derive income from the interest payments on the gains from selling mortgage-backed securities. These are the types of REITs that are linked to real estate financing. In Equity REIT vs Mortgage REIT, the best one where management of properties and physical ownership is not included is the second one.

Furthermore, Mortgage REITs do not benefit directly from property appreciation. They focus on the spread of interest rate, which is the difference between the total interest you earn on mortgage investments and the cost of copying. This can make Mortgage REITs more sensitive to changes in interest rates compared to Equity REITs.

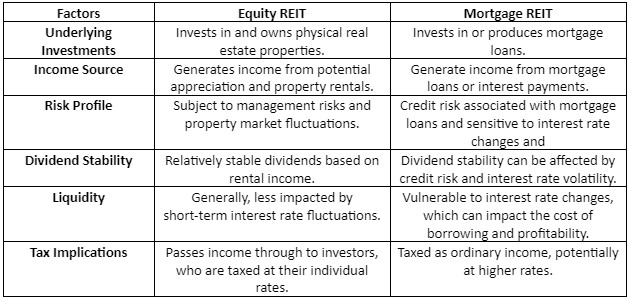

The difference between the two main types of REITs across different factors is as follows:

You may read:

Wrap Up

In the article, we have uncovered the secrets of REITs and discuss the difference between the two major types: Equity REIT VS Mortgage REIT. In terms of real estate, both these types of REITs cater to different investor preferences. Equity REITs provide ownership and management of physical properties. It offers a stable income stream from rentals and the potential for property appreciation. On the other hand, Mortgage REITs focus on the financing side, with income derived from interest payments on mortgage loans or gains from selling mortgage-backed securities.

Understanding the distinctions between Equity REITs and Mortgage REITs is crucial for investors to align their investment strategies with their financial goals. For more understanding about this topic, consult real estate professionals, such as Sapphire Properties.

FAQ's

Our Major Projects In Lahore

Our Major Projects In Islamabad

Other Projects