Real Estate Owned (REO) are the properties that many lending institutions repossessed after an unsuccessful foreclosure auction. These institutions generally include a mortgage lender or a bank. When a homeowner fails to make mortgage payments, the investor initiates the foreclosure process, leading to a foreclosure auction. If the property does not sell at auction, it becomes Real Estate Owned.

The given article will discuss what REO properties are and we will also explore the reasons behind their existence. We will also explore the process of acquisition and the opportunities and challenges they present to buyers and investors.

The journey of a property to becoming Real Estate Owned is often difficult sometimes due to financial distress and hardship. Homeowners may face sudden circumstances such as illness, job loss, or other financial setbacks, leading to the incapability to meet mortgage duties. As missed payments accumulate, the lender may initiate foreclosure proceedings to recover the outstanding debt.

You may also like:

Foreclosure Process

The Lender's Dilemma

When a property becomes Real Estate Owned (REO), the lender assumes the responsibility of managing it. Banks and financial institutions, being in the business of lending money rather than managing real estate, often find themselves faced with a dilemma. The holding of REO properties on their books can lead to financial strain and a diversion of resources from their core operations.

Opportunities for Buyers

For prospective investors and buyers, REO properties represent an opportunity to acquire real estate at potentially favorable prices. Do you want to know how to find reo properties? It’s really easy. You only have to search for the listing. Banks are motivated to sell these properties quickly to recoup their losses and mitigate the financial burden associated with holding non-performing assets. As a result, REO properties are often priced below market value, presenting an attractive prospect for those seeking real estate investments.

Due Diligence is Key

While the attraction of a discounted property is tempting, buyers must exercise due diligence when considering the purchase of an Real Estate Owned (REO) property. These properties are typically sold “as-is,” meaning the buyer assumes responsibility for any repairs or renovations needed. Conducting a thorough inspection and understanding the property’s condition is crucial to avoiding unexpected expenses.

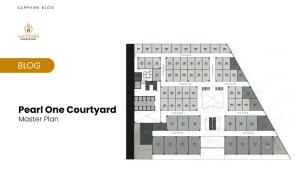

You may also like:

Navigating the Purchase Process

The process of purchasing an REO property can be different from a traditional real estate transaction. Buyers may encounter additional paperwork and a more extended timeline. Working with a real estate agent experienced in dealing with REO properties can be invaluable in navigating the intricacies of the purchase process.

Potential Challenges

While REO properties offer potential rewards, they also come with their share of challenges. The condition of these properties may vary, and some may require significant renovations. Moreover, the competition for these properties can be fierce, with multiple buyers vying for the same opportunities. Additionally, the negotiation process may differ from standard real estate transactions, as banks may have their own set of procedures and requirements.

The Role of Investors

Real estate investors often play a significant role in the REO market. These investors, ranging from individual buyers to institutional funds, actively seek opportunities to acquire distressed properties, renovate them, and either sell or lease them for a profit. The infusion of investor capital into the REO market can contribute to neighborhood revitalization by transforming neglected properties into well-maintained assets.

Mitigating Risks

To mitigate the risks associated with REO investments, buyers and investors must conduct thorough research, engage professionals such as real estate agents and inspectors, and have a clear understanding of their financial capacity and goals. Additionally, having a realistic budget for potential renovations and repairs is essential to avoid financial strain.

You may also like:

End Note

Real estate owned properties, born out of financial distress and foreclosure, offer a unique set of opportunities and challenges for buyers and investors alike. While the appeal of discounted prices may be tempting. In addition, navigating the complexities of the REO market requires careful consideration, due diligence, and a clear understanding of the associated risks. As the real estate landscape continues to evolve, the role of REO properties in the market will persist. Thus, presenting opportunities for those willing to undertake the journey of turning distressed assets into valuable investments. For more information, you can contact Sapphire Properties, the best real estate company in the city.

FAQ's

The homes that fall under the possession of an investor or mortgage lender, are Real estate owned (REO) properties. It is due to the reason that property cannot be sold at auction.

Our Major Projects In Lahore

Our Major Projects In Islamabad

Other Projects