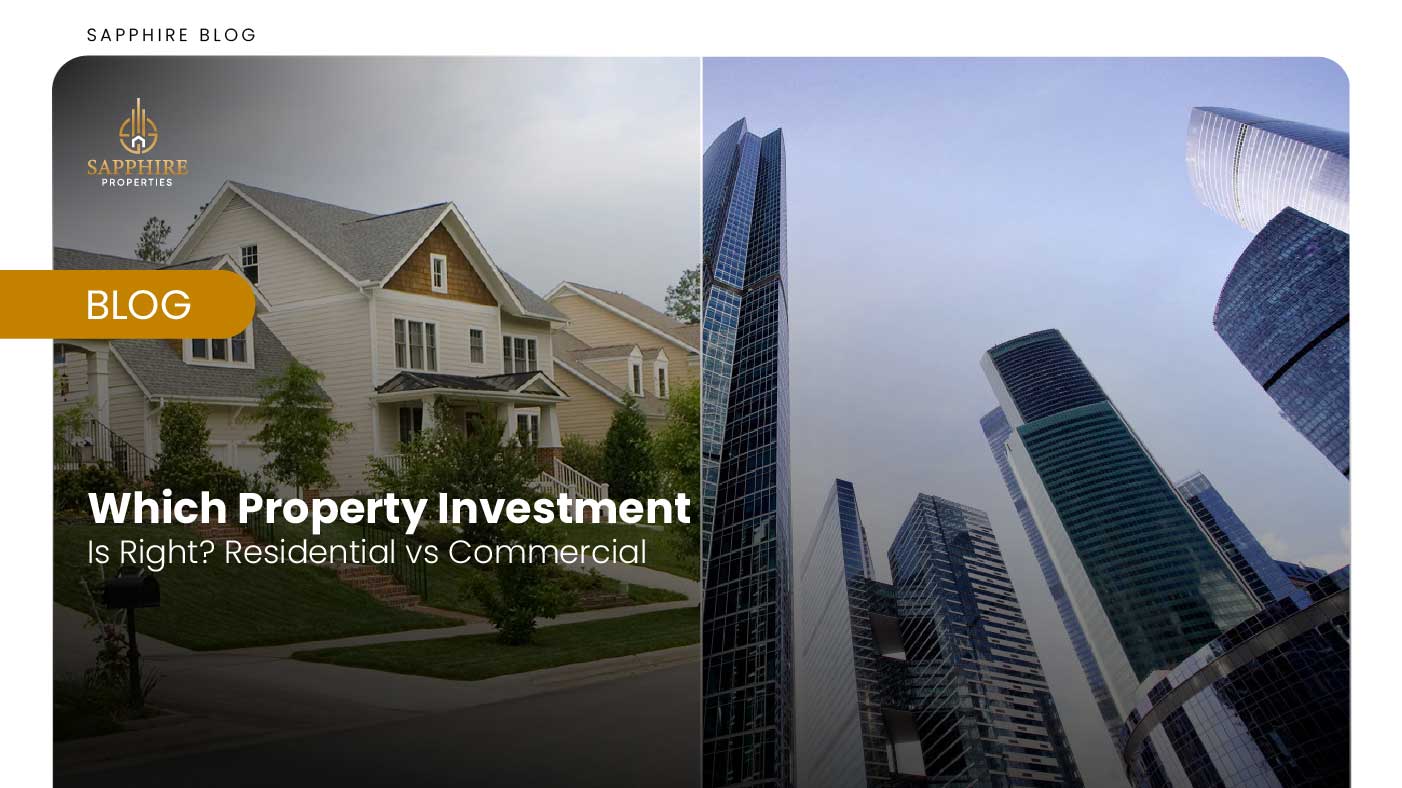

Real estate investment is a widespread choice for many investors looking to build wealth and save their future. When it comes to real estate, two primary categories stand out: residential and commercial properties. Each offers unique advantages and challenges. Thus, making the decision when it comes to Residential vs Commercial is a crucial one for any prospective investor. So, which is better for you?

To answer that question, let’s explore the key considerations and differences of residential and commercial property investments.

To know the residential vs commercial properties, let’s separately explain what residential Property is and what commercial Property is.

You may read:

Residential Property Investment

Residential properties are typically multi-unit dwellings, single-family homes, or apartment complexes designed for people to live in. These properties are meant for habitation and provide housing to individuals and families. Many residential plots in Pakistan are available for sale. Here are some key points to consider when thinking of investing in any residential plot for sale.

Steady Demand: Residential properties enjoy a consistent demand, regardless of economic conditions. People will always need places to live, so you are less likely to experience extended vacancies.

Ease of Entry: Investing in residential properties is often more accessible to the average investor. When it comes to Commercial vs Residential investment, you don’t need a large capital base to get started. It is the reason residential investment is an attractive option for beginners.

Management: Residential properties are generally easier to manage because they typically involve individual tenants. This can reduce the complexity and demands of property management.

Residential Financing: Financing for residential properties is more readily available and typically comes with lower interest rates, making it easier to secure a mortgage.

Appreciation Potential: Residential properties can appreciate over time, especially in desirable neighborhoods, potentially offering capital gains. So, when we compare residential vs commercial, residential properties have appreciation potential.

Residential Property Challenges

It is also important to consider the downsides of residential property investment:

Market Cycles: Residential real estate can be influenced by market cycles, with fluctuations in demand and property values.

Tenant Turnover: Dealing with tenant turnover can be time-consuming and costly. Finding new tenants, screening them, and managing leases can be a hassle.

Property Maintenance: You’ll need to stay on top of maintenance and repairs. It can be a significant responsibility if you own multiple residential properties.

What is Commercial Property?

Now comes the question: what is commercial Property? It includes office buildings, industrial warehouses, retail spaces, and other structures intended for business use. Here are some key considerations for commercial property investment:

Stable Income: Commercial leases are often longer and can provide a stable income stream. Tenants are typically businesses that sign longer-term leases, so you’re less likely to experience frequent vacancies. In residential vs commercial, you have the benefit of stable income in commercial properties.

Higher Rental Income: Commercial properties tend to generate higher rental income compared to residential properties, making them attractive for investors seeking significant cash flow.

Lower Management Intensity: Commercial tenants often assume more responsibilities for maintenance and property upkeep, reducing the burden on the property owner.

Diverse Tenant Base: Commercial properties can house a variety of businesses, reducing your reliance on a single source of income.

Commercial Property Investment Challenges

Commercial property investment has its own set of challenges. If you are looking for a commercial plot for sale or looking for commercial property investment options, you need to consider the following challenges:

Market Sensitivity: Commercial real estate can be more sensitive to economic downturns. Economic volatility can impact the success of businesses, which, in turn, can affect your rental income.

Complex Leases: Commercial leases tend to be more complex, and negotiations can be more challenging than residential leases. It’s crucial to understand the terms and conditions thoroughly.

Capital Requirement: The initial capital required for commercial property investment is often higher than for residential properties, making it less accessible for some investors.

Market Expertise: Investing in commercial properties may require a deeper understanding of the specific market and location, as well as the needs of commercial tenants.

Which Is Better for You? Residential vs Commercial

Now, if we talk about Residential vs Commercial and what is best for you, it ultimately depends on your financial goals. In addition, it also depends on risk tolerance and your expertise in real estate. If you’re looking for steady and lower-risk income, residential property investment might be your best bet. Blue World City is one of the best housing societies for that purpose.

On the other hand, if you have a higher risk tolerance and seek higher rental income, you can think of commercial property investment. In addition, if you have a solid understanding of the commercial real estate market, you should invest in commercial Property. One of the commercial projects is the Blue World Trade Center, where you can invest for maximum benefit.

Take Away

In conclusion, there is no one-size-fits-all answer to the residential vs commercial property investment question. Your choice should align with your investment goals and your ability to manage the unique challenges and advantages that each type of property offers.

Consulting with a financial advisor or real estate professional at Sapphire Properties can help you make an informed decision that aligns with your investment strategy and long-term objectives.

FAQ's

Residential Property is area developers for dwelling or living for households or individuals. Residential Property includes single dwellings to large apartments and buildings.

When it comes to the best in Residential vs Commercial, it all depends on your budget, your priorities, and your needs.

The clear difference between the two is that residential real estate is for living, and commercial real estate is for business. Commercial properties are easy to sell as compared to residential properties.

Our Major Projects In Lahore

Our Major Projects In Islamabad

Other Projects